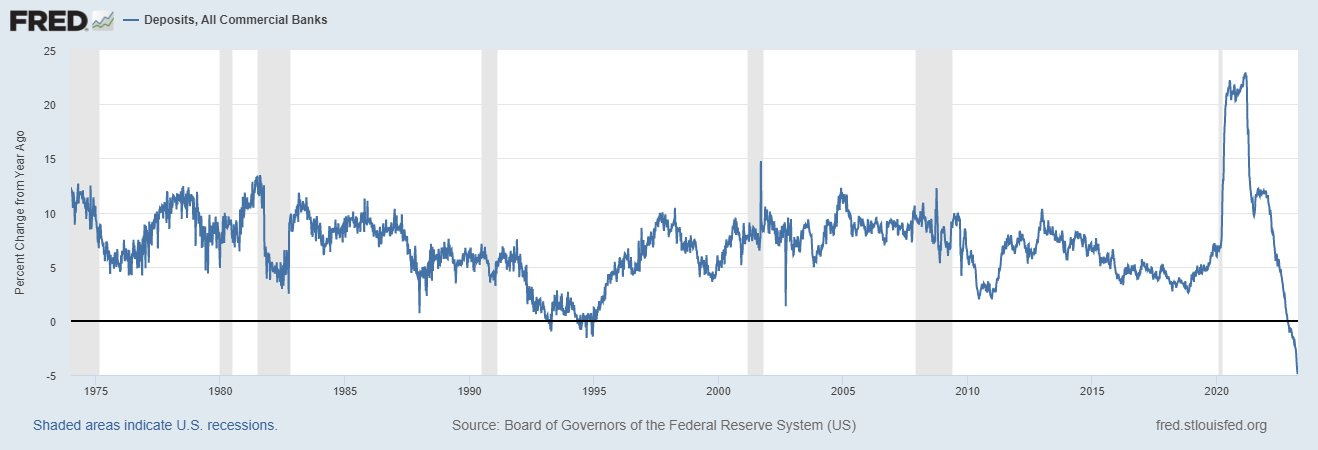

The above chart is from the Federal Reserve that tracks the money supply in banks.

The shaded areas show periods of recession. The recession of 2008 was dominate, but the money supply didn’t drop dramatically.

In 2020, there was a brief recession that was rescued by a massive injection of dollars being printed in the TRILLIONS and accounts for the spike in bank deposits increasing dramatically. We can thank the Covid con bandits for this!

As inflation heated up and people needed more cash, they have been tapping into their savings in the banks and they have pulled out cash by the car load.

In turn, bank liquidity is rapidly falling and is signaling that there will be more banks that will go insolvent.

Gasoline prices are now climbing and a $60 Tankful now costs $80. They don’t include energy costs (natural gas) gasoline and food costs being part of core inflation. The gas lighting goes on by the clowns in DC and they continue to lie to the American public and continue to make decisions that make things WORST!

Does not bode well for the economy.

My thoughts for the day!

Thomas A Braun Rph

I would think the commercial banks would have excess liquidity, and just the opposite is true. Where did the money go? Now the Clowns in DC, are saying that if Mr. Banker you go insolvent..don't worry we will give you cash! That's what they did with the woke bank SVB. Go to get rid of the brain dead politicians in DC!

"The last act of a decaying empire is to rob the treasury."